Los Angeles County Posted the Biggest Population Drop of Any County in New Census Data

Los Angeles County had the biggest population loss of any county in the United States, according to the latest census figures that reflect shifts emerging in the pandemic.

The U.S. Census Bureau released its updated population data for 2021, which measures the change in population from mid-2020 to mid-2021. Among the broader trends shared across all Southern California metropolitan areas was the drop in natural population growth — which tracks the number of births versus deaths — compared to 2010 through 2020. Similarly, Inland Empire, Los Angeles, Orange County and San Diego all saw the number of international migrants drop relative to the prior 10-year period with more-restrictive entry requirements amid the pandemic.

Inland Empire has always been an outlet for spillover demand from coastal Southern California residents chasing affordable housing costs. It affords residents the opportunity to remain in Southern California while still being within a reasonable distance from coastal job nodes in Irvine, Los Angeles and San Diego.

That trend typically accelerates during economic downturns and periods of economic uncertainty, which was the case in 2021. And given that many office workers have transitioned into a hybrid work model or are fully remote, longer commutes have become more tolerable, which might mean that fewer of those residents return to coastal markets once conditions return to a period of relative normalcy.

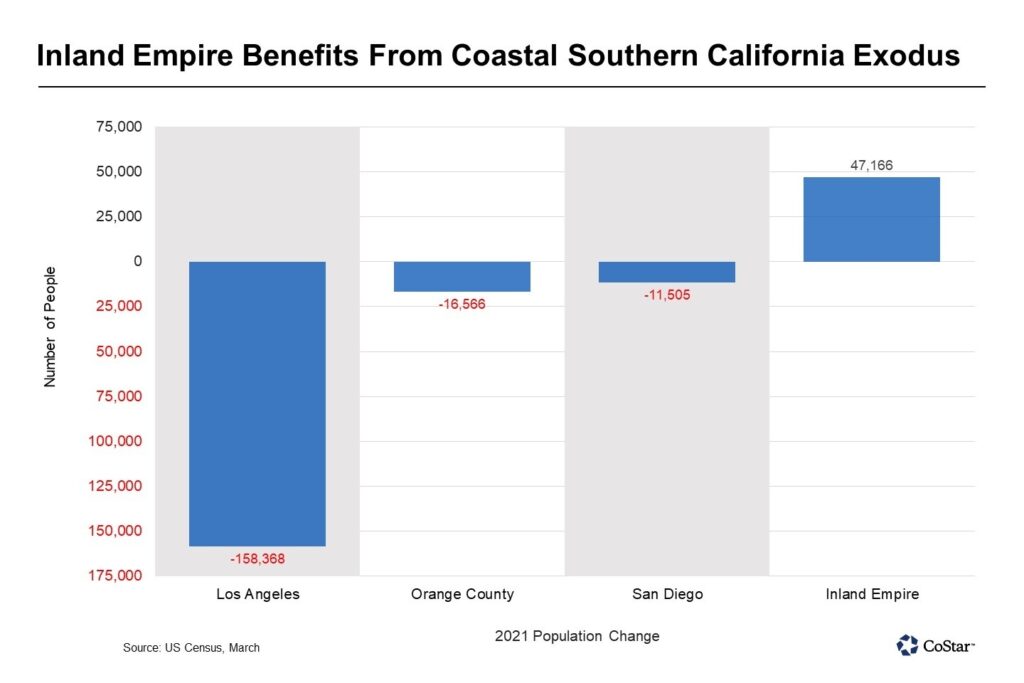

Inland Empire’s population grew by nearly 50,000 new residents in 2021, many of whom moved into the interior of Southern California to find affordable housing options. That was driven in large part by an increase in domestic migration, which tripled the prior 10-year average.

The average asking rent in the Inland Empire apartment market is $1,950 per month. That’s $200 per month cheaper than Los Angeles, $300 per month cheaper than San Diego, and nearly $600 per month lower than Orange County’s average rental rates.

Los Angeles County saw its population decline by just under 160,000 during this time, a population loss that no other U.S. county equaled. On a percentage basis, total population declined by 1.6%. The county saw net outmigration of 175,000 people. Although L.A. County has seen net outmigration for years, this result is more than three times the average number of residents that left L.A. County from 2010 through 2020 on a net basis.

In recent years, international migration and natural growth have been key counterbalances to the domestic outmigration. International migration, although positive, was just 15% of average annual levels witnessed during the prior decade. Natural growth was only one-third of the 10-year average.

San Diego’s population shrunk by more than 11,000 people for this period, according to the Census data. That was the largest drop in the past decade. Typically, international migration and natural growth drive population growth in the region, but international migration was only marginal, while the natural increase was cut in half relative to the prior 10-year period. The net population loss was 0.3% year over year, compared to 0.7% growth on average during the trailing decade.

Various reports published in the past year have suggested that San Diego is the country’s most unaffordable market to live in based on prevailing household incomes relative to housing costs and inflation. That, in addition to flexible working options, has fueled relocations away from the county.

Similarly, Orange County’s population shrunk by 0.5%, or more than 16,000 from mid-2020 to mid-2021. Domestic outmigration was roughly 2.5-times the average between 2010 to 2020, while the natural increase fell by more than 50%.

That has corresponded with median home prices in the county rising to more than $1 million, with that figure higher in Orange County’s primary office nodes in the airport area and the Irvine Spectrum. There is concern that the lack of housing, and the high cost of what housing there is, could inhibit the full economic recovery for the county given that the labor market is still more than 50,000 positions short of what it was in February 2020, according to the latest release from California’s Economic Development Department.

Gulshen Kaur

Rpm Commercial Real Estate

Investment Sales-Leasing-Management

525 S. Douglas Street, Suite 270

El Segundo, CA 90245

562-225-9260 mobile

424 281-3704 direct

424 281-3707 fax

CA DRE#01889843